We Ensure a package suitable for you

Simple funding and finance solutions for Home owners and Business owners.

About us

Our company has a wide range of funding sources available, providing for both new and existing customers with access to finance solutions with well established relationships and partnership agreements in western banks and eastern banks with the top finance companies Eijaz Finance broker company will ensure you receive a finance package that is suitable for your business.

HOW IT WORKS

We can provide

A letter of credit is essentially a financial contract between a bank, a bank’s customer and a beneficiary. Generally issued by an importer’s bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

A standby letter of credit, abbreviated as SBLC, refers to a legal document where a bank guarantees the payment of a specific amount of money to a seller if the buyer defaults on the agreement. An SBLC acts as a safety net for the payment of a shipment of physical goods or completed service to the seller, in the event something unforeseen prevents the buyer from making the scheduled payments to the seller. In such a case, the SBLC ensures the required payments are made to the seller after fulfillment of the required obligations.

A bank guarantee is a type of financial backstop offered by a lending institution. The bank guarantee means that the lender will ensure that the liabilities of a debtor will be met. In other words, if the debtor fails to settle a debt, the bank will cover it. A bank guarantee enables the customer (or debtor) to acquire goods, buy equipment, or draw down a loan

A blocked fund is defined as money or capital realized when a foreign operation involving the transfer of funds is blocked as a result of regulations imposed by the government of the country where the money was generated. When a fund is suspected to be generated from illegal activities or criminal acts, the government can impose certain regulations hindering the money from being be transferred. The fund then becomes a blocked fund.

A bank draft is a payment on behalf of the payer, which is guaranteed by the issuing bank. A draft is used when the payee wants a highly secure form of payment. The bank can safely issue this guarantee because it immediately debits the payer’s account for the amount of the check, and therefore has no risk.

Proof of Funds (POF) is a letter or documentation that certifies that an individual, institution, or corporation has sufficient funds (money) to complete a transaction. A POF is typically issued by a commercial bank or custody agent to provide confidence or assurance to another party – typically a seller – that the individual or entity in question has sufficient funds to complete an agreed-upon purchase.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

A security bond is a contract between three or more parties: a supplier of some kind, their client and an insurance company. Security bonds guarantee that suppliers can meet financial obligations when contracted performance targets are missed.

A credit facility is a type of loan made in a business or corporate finance context. It allows the borrowing business to take out money over an extended period of time rather than reapplying for a loan each time it needs money. In effect, a credit facility lets a company take out an umbrella loan for generating capital over an extended period of time. Various types of credit facilities include revolving loan facilities, committed facilities, letter of credit and most retail credit account.

A cash investment is a short-term obligation usually fewer than 90 days that provides a return in the form investment interest payment. Cash investment generally offers a low return as compared to the other investments. They may also have very low levels of risk in addition to being insured by the Federal Deposit Insurance Corporation (FDIC)

A single credit transfer is a payment transaction by which payment services provide transfer of funds to a payee order once the payer can be payee himself

How Can We Support Your Business

Import letters of credit give you an extra cover and control so you get exactly what you need, when you need it. You’ll know that your seller can claim payment only if they comply with all the terms in the letter of credit.

How We Make Things Happen

Part of company meetings for financing Qatar High Speed Group by Hunan Group

Signing ceremony MOU to establish ALLIANCE GLOBAL BANCO LTD in Africa - The first regional bank classified as AAA+ to financing African renaissance projects

Meet Our Team – Dubai & Abidjan Branches

Shaikh. Fayez Al Qassimi

CEO

Dr. Mubark Ibrahim

General manager

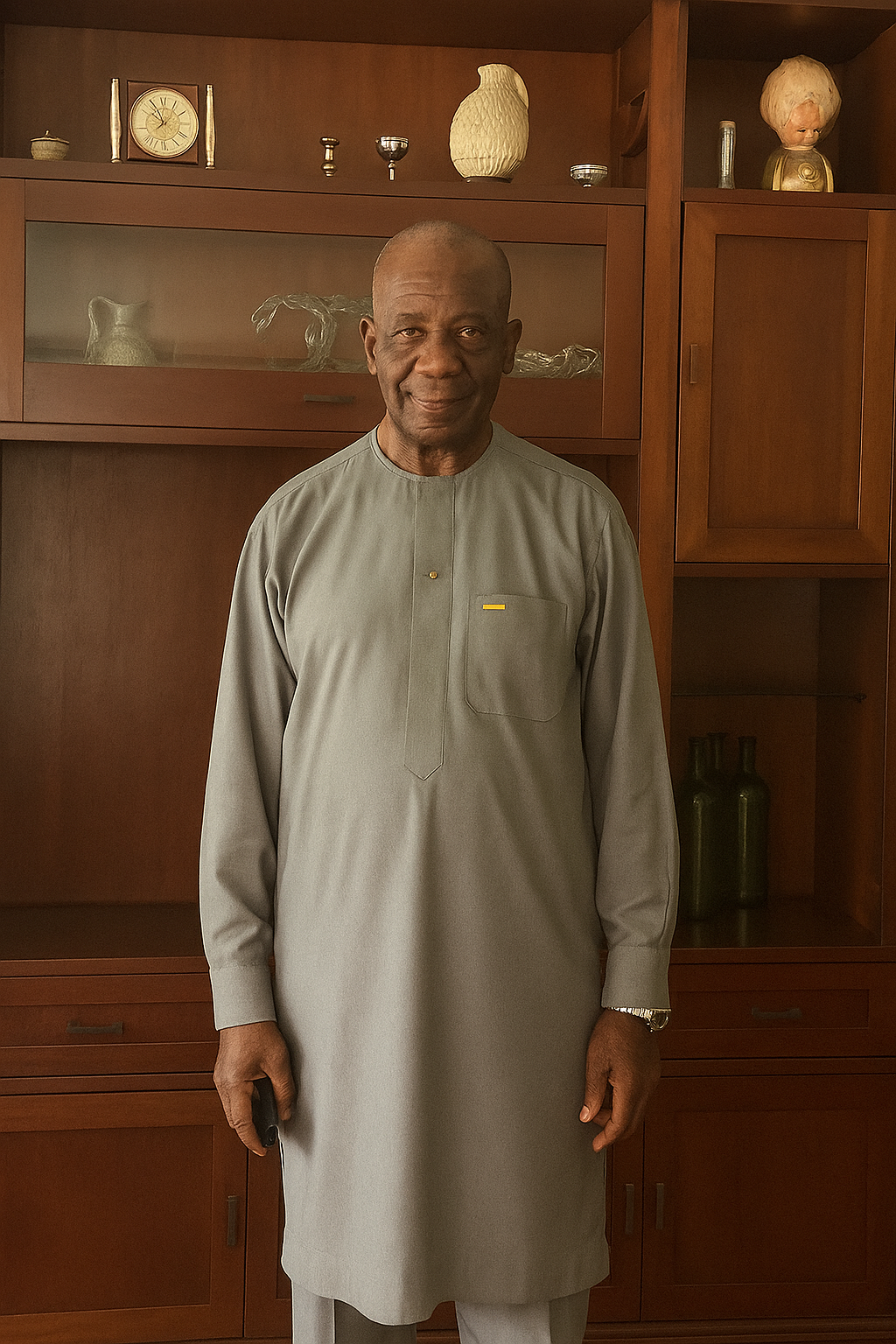

MR. Aboubacar Diombera

Office manager – Abidjan branch

Elise Lumiere

Secretary